Use Contingencies To Protect Your Right To Cancel a Sale

Kristen and Ben had been looking for the right property to buy for over six months. They finally found a home that seemed to be about perfect, so they put down a deposit and signed a Purchase and Sales Agreement.They were excited to have their property search over with, but they still wondered if they had made the right choice. The house would be the biggest purchase they had ever made, a lot of money was involved, and they wanted to have an option available if for some reason they changed their mind.

“Contingencies” written into a Purchase Contract are one of the best ways to insure that you will have way to cancel the sale during the contingency period when inspections are made and the issues are either removed or resolved between the Buyer and Seller.

Contingencies will contain a time limit in which to fulfill the task. For example, an inspection contingency may give you 10 days in which to obtain and approve a pest or termite control report, a building inspection unless the property is purchased in “as is” condition. A contingency clause may allow 5 to 10 days for you to obtain a written loan commitment. The seller is generally given a certain number of days in which to deliver “marketable title” or a title report to the buyer. You then can review the exceptions listed in this report, and dispute any items which are in question. One common example of a title exception may be an easement. For example. If you plan to add a swimming pool in an area where an easement exists, you will want to be sure this will be possible.

Once a contingency has been approved, both the you and the seller sign a document removing that contingency from the purchase contract. This agreement should be given to your closing agent and real estate agent. If the deadline for a contingency arrives, and both parties do not sign off on that contingency, this failure to act serves as acceptance of the contingency. For this reason, it is important to keep a calendar of the dates for removal of each contingency.Contingencies help prevent problems at closing by eliminating last minute disputes covering inspections, the buyer’s inability to obtain financing, or repair work not being done according to contingency specifications.

Almost no contract automatically includes a clause that determines what will happen in case of death, since buyers assume your heirs (or the executor) will step up to close the deal. And, if the agreement is “silent” on what happens in case of illness or death, the contract continues to be enforceable.

A default clause describes what happens when a Buyer or Seller defaults under the contract. If the case goes to trial, a judge will decide what remedies are available. Some contracts provide that in case of default, the parties will go to arbitration. Your attorney should review the agreement to see whether everything was done properly. If not, then you may be able to cancel the agreement.

Common Contingencies

- A financing contingency allows a specified amount of time for the Buyer to obtain a loan commitment and acceptable financing terms. These can be as specific as a designated interest rate or loan term. If not approved exactly as stated, the buyer has the option to cancel.

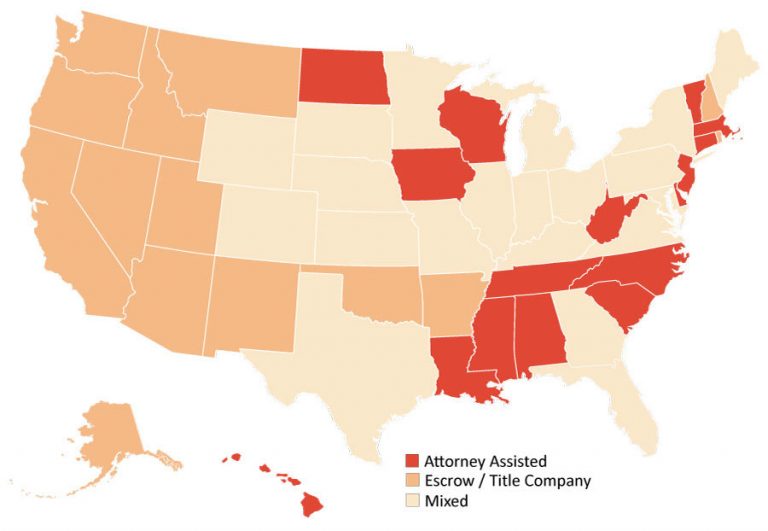

- An inspection contingency, depending on your state law, can be written to include property inspections that cover possible structural problems or material defects. It can specify who will pay for necessary repairs, and to what extent each party is willing to pay for those repairs. This can also include termite damage; the presence of radon, lead or asbestos; and whether the property is in a flood or an earthquake zone.Attorney approval means the contract is subject to passing legal scrutiny. That can include an attorney review, title report or any other legal paperwork (such as condominium documents) that relate to the purchase.

- The sale can subject to the approval of a condominium or co-op board.

- If you suspect recent remodeling or additions were done on the property, the purchase contract may be reliant on proof that the necessary building permits were obtained and building codes were enforced.

Recently, buyers from out of state made an offer to buy a newly built home. It was ideal, with amenities such as a swimming pool and location on a golf course. The buyers were envisaging decorating and furnishing this beautiful house. Several weeks into the sale process, the buyers realized the home was in a high-crime area, and bulgaries were common in the community. They also found that the morning traffic to go to their places of work would be a nightmare. The closing date was set. Their mortgage had been approved. The couple agonized how they could get out of the purchase without loosing their downpayment money. It seemed impossible.

The day before the closing, the buyers noticed a clause in the purchase agreement that stated new palm trees must be planted in the driveway leading up to the home. In their final inspection, there were no trees were planted. They telephoned the seller’s closing agent and said that the deal was off. The builder had failed to live up to the contingency that the trees would be planted before the closing date, no exceptions allowed.

The buyers were refunded their full downpayment. They went on to find a home in a safer area, with a good commute, and although not a new home, with minor repair and cosmetic work, the house would be as good as new.