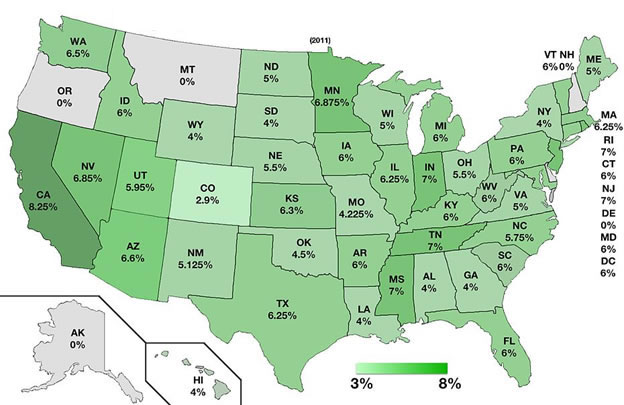

What States Have No State Income Tax?

There are currently nine states which do not require you to file a state income tax return.

States with no individual income tax

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee,Texas, Washington, and Wyoming.

In New Hampshire, you are required you to file only if you have dividend or interest income to report.

States which require a state tax return

States which do require you to file a state income tax return are:

Flat Income Tax vs. Range Income Tax

Nine states — Colorado, Illinois, Indiana, Kentucky,Massachusetts, Michigan, North Carolina, Pennsylvania and Utah — have a flat income tax, while the rest collect according to income ranges. The ranges that apply to 2022 tax rates vary not only by percentage but also by the amount of brackets within the range, with the fewest being one, the flat tax, and the most being 12. Whether you plan to file as a single or married person also affects the tax rate.

For example, New York state has nine income tax rates: 4%, 4.5%, 5.25%, 5.85%, 6.25%, 6.85%, 9.65%, 10.3% and 10.9%. New York state income tax rates depend on your taxable income, adjusted gross income and filing status. Residency status also determines what’s taxable.

California also has nine state tax brackets: 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. The California income tax brackets are based on taxable income as well as your filing status. In California, married couples filing jointly simply double the percentage. To learn what the income tax rates and brackets are for your state, go to www.taxfoundation.org. or www.irs.gov/tax topics: What is the income tax rates by states? Or visit your state’s Department of Revenue website.