Why Is My FICO Score So Important in Getting a Mortgage?

Most lenders rely on a credit score, called a “FICO score” to determine a Borrower’s creditworthiness when applying…

Most lenders rely on a credit score, called a “FICO score” to determine a Borrower’s creditworthiness when applying…

Real estate closings can be fraught with complications and setbacks, but they can go smoothly and quickly —…

The Purchase Agreement (or Residential Purchase or Sales Agreement and Deposit Receipt) is the overriding document that will…

Depending on your annual income, cash reserves, creditworthiness, and the appraised value of the property, you may be…

There are currently nine states which do not require you to file a state income tax return. States…

Kristen and Ben had been looking for the right property to buy for over six months. They finally…

Holding title to real property as Community Property is a type of ownership available to married couples only….

One of the most important decisions that needs to be made at closing is how you choose to…

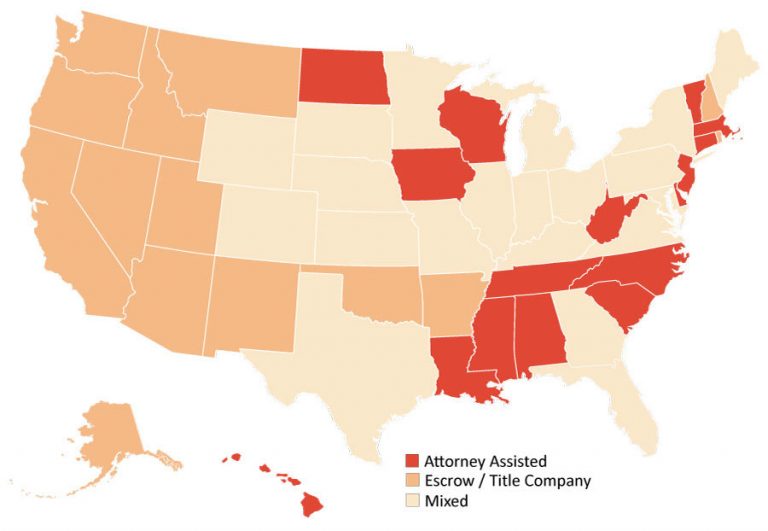

Here is a summary of closing practices for each of the United States. This is a general reference guide. Local practices within your city or county may differ.

Once you have opened escrow and given the escrow officer the details of your purchase, you will next…

Evelyn Hunter wanted to deed a small condominium apartment in Pasadena, Ca., to her grandchildren. Because this property…

As a potential Buyer, you may have have no reason to suspect that an outstanding permit exists on…

Seller financing can be a useful tool to not only the Buyer but also to the seller. With…

With all the many tasks necessary to ensure a smooth closing, there is one area of concern that…

You may think of an easement as just a right of way that is given over your property…

Let’s assume that you are in the category of buyers who need to find a property now and…

Most real estate associations have prepared COVID-19 addenda similar to those found in the California addendum, though the…

Consider banks, savings and loan offices and loan brokers: Find out what types of loans are available and…