Will I Have to File a State Income Tax Return?

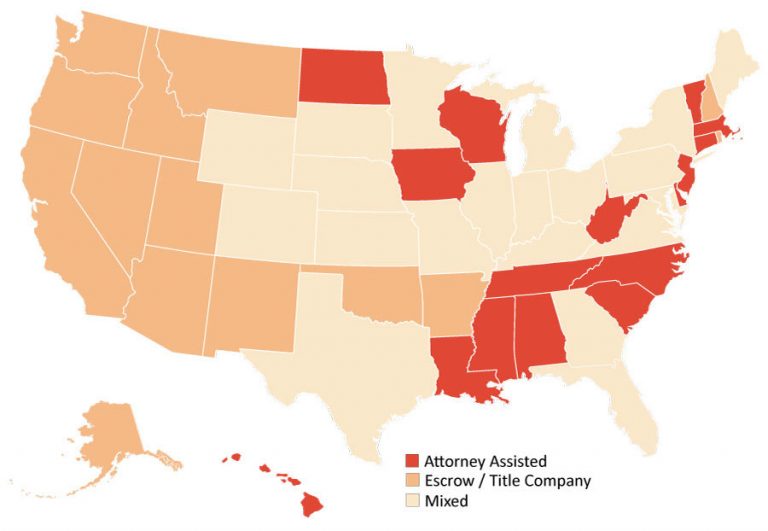

![income-tax-map[1]](https://sandygadow.com/wp-content/uploads/2015/10/income-tax-map1.jpg) There are currently seven states which do not require you to file a state income tax return.

There are currently seven states which do not require you to file a state income tax return.

States with no individual income tax

Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

The two states in Blue, Tennessee and New Hampshire, require you to file only if you have dividend or interest income to report.

States which require a state tax return

States which do require you to file a state income tax return are:

| Alabama Arizona Arkansas California Colorado, Connecticut Delaware District of Columbia Georgia |

Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine |

Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska |

New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon |

Pennsylvania Rhode Island South Carolina Utah Vermont Virginia West Virginia Wisconsin |

Flat Income Tax vs. Range Income Tax

Seven states — Colorado, Illinois, Indiana, Massachusetts, Michigan, Pennsylvania and Utah — have a flat income tax, while the rest collect according to income ranges. The ranges that apply to 2012 tax rates vary not only by percentage but also by the amount of brackets within the range, with the fewest being one, the flat tax, and the most being 12. Whether you plan to file as a single or married person also affects the percentage required.

New York, for example, has the following brackets for 2102 for single persons, with the percents simply doubling for married persons filing jointly:

- 4 percent on first $8,000

- 4.5 percent between $8,001 and $11,000

- 5.25 percent between $11,001 and $13,000

- 5.9 percent between $13,001 and $20,000

- 6.85 percent between $20,001 and $200,000

- 7.85 percent between $200,001 and $500,000

- 8.97 percent on more than $500,000

Alabama has a significantly lower income tax for its residents. Single persons, heads of families and married persons filing separate returns pay:

- 2 percent on first $500

- 4 percent between $501 and $3,000

- 5 percent on more than $3,000

Married persons filing jointly pay:

- 2 percent on first $1,000

- 4 percent between $1,001 and $6,000

- 5 percent on more than $6,000

California spans a much wider range of taxpayers. Single persons and married persons filing separately pay:

- 1.25 percent on first $7,060

- 2.25 percent between $7,061 and $16,739

- 4.25 percent between $16,740 and $26,419

- 6.25 percent between $26,420 and $36,675

- 8.25 percent between $36,676 and $46,349

- 9.55 percent on more than $46,350

In California, married couples filing jointly simply double the percentage. The above percentages apply to taxable income, meaning that deductions can move you to a lower tax bracket.

To learn what the income tax rates and brackets are for your state, contact your state’s department of revenue.