When Selling a House, Avoid Awkward Misunderstandings Over Fixtures and Furnishings

State-of-the-art appliances, sleek lighting fixtures and tasteful window treatments can all make a memorable impression on potential home…

State-of-the-art appliances, sleek lighting fixtures and tasteful window treatments can all make a memorable impression on potential home…

Real estate closings can be fraught with complications and setbacks, but they can go smoothly and quickly —…

The Purchase Agreement (or Residential Purchase or Sales Agreement and Deposit Receipt) is the overriding document that will…

Holding title to real property as Community Property is a type of ownership available to married couples only….

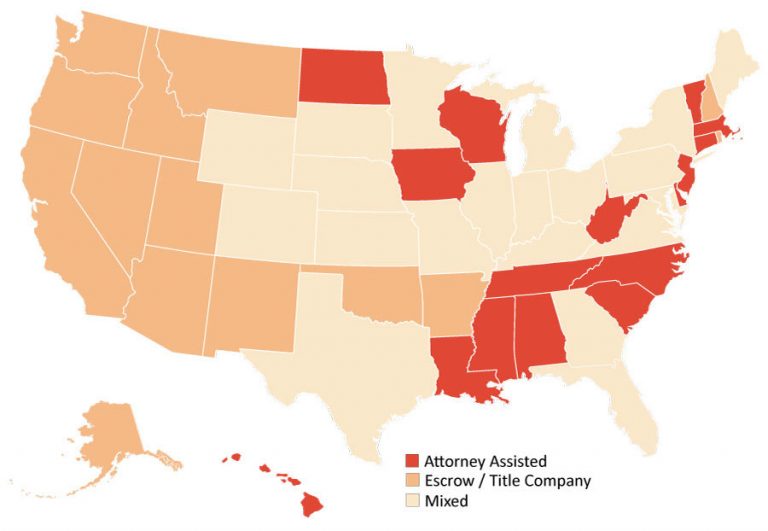

Here is a summary of closing practices for each of the United States. This is a general reference guide. Local practices within your city or county may differ.

As a potential Buyer, you may have have no reason to suspect that an outstanding permit exists on…

Lona Hamilton had been struggling to make her mortgage payments for the last year and a half. She…

Seller financing can be a useful tool to not only the Buyer but also to the seller. With…

If you find a foreign buyer for your property, you may be concerned that selling to a non-U.S. citizen might complicate the closing process. Will additional paperwork be required? Will there be problems with clearing the buyer’s funds? Are there unusual challenges if the potential buyer intends to obtain a mortgage?

There are currently seven states which do not require you to file a state income tax return. States…

The Tax Reform Act of 1986 required anyone responsible for closing a real estate transaction, which may include…

Buyer’s Home Closing Checklist Have you made a final walk-thru inspection of the property? Is the condition of…

Real estate closings may be handled by escrow companies, title companies, lawyers, or a combination of one or…

Jack and Eliza searched Fayette county in Virginia for the right house. Not only must it be in…

Choosing the right escrow officer or title attorney to handle your sale can mean the difference between a…

New York Times April 27, 2012 There’s no lack of information on the Internet about real estate closings….

Although you may not feel you need to speak with your closing agent until you are well into…

There are several things you can do to be certain that your real estate transaction will close on…