Closing and Settlement Q&A

“Closing” or settlement or “escrow” is listed as one of the top ten problem areas that occurs in a real estate transaction. It is probably the least understood, and most feared, aspect in a property purchase. Misunderstandings about closing costs can result in hundreds or even thousands of dollars of needless expenses, and put seemingly solid deals at risk. This final step to your purchasing a home or property can go smoothly if you take a few precautions beforehand. Knowing what questions to ask and reviewing all documents well in advance of the closing day will prepare you for a hassle-free and smooth closing.

Can you learn how to save money at closing?

Can you learn how to control your closing?

Yes, you can.

Here are the answers to common closing and escrow questions to help make your home buying process go smoothly and perhaps to save you money in the process.

- What is closing or escrow and what is involved in opening escrow?

- What should a purchase agreement include?

- How long does a title search take?

- What are the most common ways to hold title?

- How should I go about shopping for a loan?

- Can I still get a loan with bad credit?

- How much will the closing costs be and what are they?

- What happens on the day of closing and can I move in on that day?

- When do I receive a copy of the deed to the property?

- I have a complaint against my escrow company. Who regulates escrow companies in California?

1. What is closing or escrow and what is involved in opening escrow?

Closing (also referred to as “settlement” or “escrow” in many parts of the country) is the process whereby an impartial third party, such as an attorney, an escrow company or a title company, is entrusted with the job of seeing that the transfer of ownership from the Seller to the Buyer takes place according to the terms of the written contract agreed upon by all parties involved. The closing agent keeps or holds any funds or documents safely until all the details have been settled and disburses them to the proper parties at the proper time. At the actual time of the closing, whereby all the parties come together to sign their appropriate documents, the seller will be asked to provide clear title to the property and the buyer will be asked to provide the funds needed to close the sale. If there is a mortgage or loan involved, the closing of the mortgage also takes place at this time.

Opening escrow or starting the closing process, simply involves visiting the office of any firm that handles closings, then handing over the deposit money and giving instructions for the transaction. Anyone who is involved in the transaction may “open escrow.” Generally, the real estate agent takes the initiative and opens the escrow. In for-sale-by-owner transactions, in which no agent is involved, either the buyer or the seller or both together may open escrow.

What law governs the payment of escrow funds to the proper party?

The underlying agreement between parties governs the payment of escrow funds to the proper party. The essential elements of an escrow are the irrevocable deposit of money or documents with a third person, and a valid and enforceable contract that calls for the delivery of that money or those documents on the occurrence of some condition (for example, the exchange of deed for money).

Who sets the closing date?

Either buyer or seller may set the closing date, both parties must agree to the date, and generally the buyer puts his request for a 30, 60 or 90 day escrow in the original purchase agreement. The seller may request a shorter or longer escrow, depending on his circumstances, and as long as the buyer agreed, that date will be set. Generally, a “financing contingency” is put into the offer to purchase in which the buyer is given a specified amount of time to obtain a mortgage. Once the buyer has a firm commitment from a lender, the actual closing date can usually be set. Be sure, if your are the buyer, to set the closing date prior to the expiration of your lender’s loan commitment or lock in date for your interest rate.

What happens if I need to extend the closing date?

If any party needs to extend the closing date of the escrow, all parties must sign and agree to an Addendum or Extension to the original purchase agreement contract. Be careful that the extension does not interfere with the lender’s obligation for a closing date.

Related Information

2. What should a purchase agreement include?

A purchase agreement must state clearly the terms of the sale and what must occur before the property can change hands. The agreement should state what will happen if the agreement is canceled, what personal property is to be included in the sale (be specific!), the date for the closing of escrow and what will happen if it is delayed, prorations and the date to be used for computing them, default provisions or what will happen if one party doesn’t live up to the agreement, who pays for property inspections and any deficiencies that they may uncover, financing arrangements and the occupancy date.

Related Information

3. How long does a title search take?

A title company examiner searches the records of the county recorder, county assessor, and other government taxing agencies to locate any documents which might affect the title to a given property. Depending on the number of documents the examiner must review, a title search will take anywhere from one hour to two weeks to complete. Read this search carefully and look for any hidden problems.

Please explain the value of title insurance.

Title insurance guarantees that the seller has legal and “marketable” title to the property which he is selling. A title search is performed by the title company or attorney handling the closing. This search will reveal, among other things, any liens or claims against the property and ascertain that the seller had good and clear title to the property. Title insurance will be issued for both the buyer and for the lender, if there is one. The lender’s policy will protect the lender for any defects in the title up to the amount of their loan. The buyer’s or owner’s policy will protect the new buyer against any flaws in the title. The policy will be good as long as you own the property. It covers events or circumstances that happened in the past, before you took title to the property.

Related Information

- What its the difference between a title theory vs. a lien theory?

- What is an attorney’s opinion of title?

- Who determines title insurance rates?

- Exceptions to coverage

- Coverage and types of title insurance

- Clouds on title

- What title insurance will do for you?

4. What are the most common ways to hold title?

- Joint Tenancy: The main distinguishing characteristic of joint tenancy is the right of survivorship. If one of the joint tenants dies, his interest passes automatically to the surviving party or parties instead of being tied up in lengthy probate proceedings. When two or more people own a property as joint tenants, they own an undivided equal interest in the property.

- Tenancy-in-Common: This is so standard a form of ownership for unrelated buyers that it is generally presumed to be the way they hold title if nothing else appears to the contrary. The shares are presumed to be equal unless stated otherwise on the deed, and each of the tenants has equal rights of possession. There is no right of survivorship; each tenant-in-common should note in his will the person or persons to whom his share will pass.

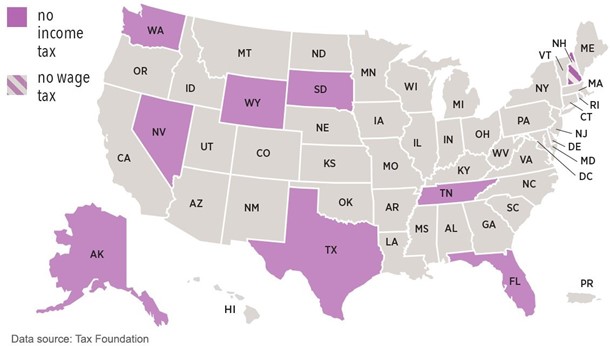

- Community Property: This type of ownership is available to married couples in nine states – Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. Both husband and wife have an equal right to possess the property during their marriage, and in some states, upon the death of either spouse, the survivor automatically receives half of the community property and the other half passes to the lawful heirs.

- Sole and Separate Property: Holding title this way means that no one else has any interest in it. If you are married and wish to take title this way, you should record a quitclaim deed from your spouse to yourself so that no community interest could be claimed at a later date (in community property states).

May I change the way I hold title after escrow closes?

Yes, at any time. You may effect the change yourself, through a written agreement, or have your escrow officer help you do it.

Related Information

5. How should I go about shopping for a loan?

Consider banks, savings and loan offices and loan brokers: Find out what types of loans are available and ask about interest rates and loan fees. Find out how quickly the lender can make an appraisal of the property. Prepare a form that makes a side-by-side comparison of the terms being offered to you by the various lenders, and think carefully about which loan would be the best for your circumstances.

What information will I need to give the lender when I make an application for a loan?

When you visit your lender, you will be asked to fill out a Uniform Residential Loan Application form. This is a four page document that asks you about your employment, your assets, your liabilities, and your income. It is important to be as truthful and complete as possible on this loan application form. All the information will be verified. Your employer will be called and your bank accounts will be checked. Upon receipt of your completed application, the lender will give you a copy of a government publication called “Settlement Costs: A HUD Guide”. This small pamphlet will explain the closing process and describe the various closings costs which you may incur with your loan. The lender is allowed three business days after receiving your loan application to provide you with this brochure.

What are the other documents that my lender is required to give me when I apply for a loan?

The lender is required to provide you with a “Truth In Lending ” statement which will tell you the APR, or Annual Percentage rate of the loan for which you are applying. The APR will be the percentage rate quoted to you by the lender, PLUS other closings costs, such as any points and other finance charges over the term of the loan. This form must also be given to you within three business days of your loan application. You will also receive a disclosure about Adjustable Rate Mortgages, a Good Faith Estimate of itemized closing costs, various authorization forms giving the lender permission to research your credit, contact your employer, request rental or part mortgage history, and verify all your bank deposits.

Once I have completed my loan application, what else should I take in with me to speed up the loan process?

Together with your loan application, you should take in your last two years tax returns, the last 2 or 3 month’s bank statements, current W-2 forms, any trust agreement or securities account information, and letters of explanation of any credit problems you may have had. The more information you provide the lender at the time of your application, the faster your loan will get processed.

Related Information

6. Can I still get a loan with bad credit?

You may qualify for a loan despite past credit problems. In most cases, you can qualify for a loan with late payment histories on your credit report. You can even qualify for a loan with a bankruptcy or foreclosure on your credit history.

What rights do I have to delete incorrect information on my credit report?

Under the Federal Fair Credit Reporting Act (FCRA) you have the right to be told if information in your file has been used against you. You have the right to dispute inaccurate information and request that it be corrected or deleted. Incorrect information must be corrected within 30 days of your request.

How do I contact the various credit bureaus to report incorrect information?

The three main credit reporting agencies are Experian, P.O. Box 2106, Dallas, TX 75002-9506, (888) 397-9506, Equifax, P.O. Box 740241, Atlanta, GA 30374, (800) 685-1111, and Transunion, P.O. Box 1000,Chester, PA 19022, (800) 916-8800. Please refer to page 74 of your copy of The Complete Guide to Your Real Estate Closing for a detailed explanation on how to contest incorrect information found in your credit report.

Related Information

7. How much will the closing costs be and what are they?

Generally, your closing costs will come out to between 4 and 5 percent of your purchase price. The closing costs will include title searches and title insurance, government taxes, notary fees, loan fees, escrow fees, recording fees, reconveyance fees, prorations and sales commissions.

How will I know how much my closing or settlement fees will be before the actual closing date?

When you applied for your loan, if you have one, you would have been given the Loan Estimate form no later than three business days after your loan application was received. This statement will have provided you with an “estimate” of what you closing costs will be.

Three business days before the actual closing, you will then be given the Closing Disclosure statement. This is the final accounting of the settlement fees you will incur at closing. It will list various fees, depending on your individual transaction, such as: the sales commission, the loan origination fee, the loan points, the appraisal fee, the credit report fee, the assumption fee, any prepaid interest, the mortgage insurance premium, the first year’s homeowner’s insurance premium, the mortgage insurance escrow account, if any, the recording fee, the transfer tax, the property survey fee, the termite report fee, any homeowner’s association fees, and any other fees specific to your particular purchase. If you do not have a loan, the closing agent will give you a settlement or closing statement to review prior to closing.

Must I check all the closing fees on the Closing Disclosure form or will the closing agent already have done that for me?

Carefully review all the fees listed on the Closing Disclosure statement before closing takes place. Check the math. Check that all the fees are what you had agreed to pay. Question any fees that you do not understand or think that may have been added without your permission. Lenders often add Courier Fees, Processing Fees, and other fees that they may not have disclosed to you at the time of your loan application.

Since my settlement or closing fees are a substantial amount of money, can I deduct them on my income tax return?

The items given to you on your Closing Disclosure statement fall into three categories relative to your income taxes: tax-deductible in the current year, capitalized (added to the price paid for the property and thereby becoming part of your base for capital gains tax purposes when you sell) or neither (personal expense). The tax-deductible items are interest, points, loan-orgination fees, any prepayment penalty, and property taxes. Those items which are capitalized are the termite clearance costs, title insurance premiums, attorney’s fees, appraisal fees, recording fees, notary fees, escrow fees, transfer taxes, and the ALTA inspection fee. The personal expense items are the first insurance premium, private mortgage insurance, and any money put into an impound account.

Reminder: In most instances, property taxes paid on your home are a deductible item on your personal income tax return. Please refer to your copy of The Complete Guide to Your Real Estate Closing for further clarification.

Related Information

8. What happens on the day of closing and can I move in on that day?

The actual day of your closing will be the day in which the buyer deposits any remaining money due into escrow and signs his escrow and loan documents and it is the day in which the seller will sign the deed and closing statements and receive a check for the money due to him. In some parts of the country, the buyer and seller go into the closing agent’s office separately. In other parts of the country, the buyer and seller go in together. Either way, closing is the day in which the deed is exchanged for the sales proceeds money. “Recording” will take place on that day, which means that the deed and any mortgage documents are taken to the county court house and recorded in the official records. These documents are them made of “public record” for anyone to see. The actual day that you can move in will be determined by local practice and the terms of your purchase agreement. It may be the day of closing, or it may be a day or two after the closing.

Why must I bring identification with me to the closing?

You will be required to sign certain documents which must be acknowledged before a Notary Public before the closing can be finalized. A notary can only accept an official identification, such as a driver’s license, passport, or other form of authoritative ID.

I have heard that closing can take hours. How long does the closing usually take?

The actual closing can take anywhere from one hour to several hours, depending on the situation. If both buyer and seller are in full agreement of all the terms of the sale, and the buyer and seller both understand all the documents they will be signing, the closing should go quite quickly. The closing agent will present the buyer with any loan documents to sign, notarize all the required signatures, and give the seller the deed and any closing documents for him to sign. If an explanation of each document is required, then the closing will take longer. This is the most important last step of your property purchase, so do not be rushed at the closing. Ask questions about any documents which you sign that you may be unsure of their content. All the documents you sign at the closing will become legally enforceable contracts and documents and bind you to certain obligations.

Is there anything I should do before I go to the closing?

Prior to your actual closing day, there are several things you should have done to prepare for the closing: You should have reviewed the letter of commitment from your lender and read and understood all the terms of the loan they are proposing to give you. You need to be sure that all inspections have been done on the property, and that you have inspected to see that any work (such as termite repair, roof repair, plumbing repair or the like) has been done. You should have read the title search report and reviewed the survey, or plot plan of the property. The survey will confirm the property’s boundaries are exactly as described in your purchase agreement. You should have obtained a homeowner’s insurance policy and provided this information to the closing agent. You should have performed a final walk-through inspection to examine the property within the last 24 hours before closing. You will want to make certain that everything is in the condition that it was in when you made your offer to purchase. You should have your certified or cashier’s check payable to the closing agent to cover the closing costs and the balance of funds due. If you are well prepared for your closing, everything should go smoothly and quickly.

Do all closings occur at a formal closing meeting?

Depending on your area of the country, the closing may be a formal meeting at an attorney’s office, escrow or title company, with all parties attending or it may be an informal signing of papers at an escrow or title company. In some areas, escrow agents process all the paperwork and arrange for all the documents to be signed, often by the buyer and the seller separately. The escrow agent then disburses the required funds to the seller.

Will I receive more documents to take home with me from the closing?

After the closing has taken place, you will be given copies of various documents. Some of these documents will be the HUD-1 Settlement Statement, which the buyer and seller will be asked to sign, the Truth In Lending Statement, the Promissory Note to the lender, binding you to pay a certain amount according to the terms of the loan, including the dates on which your loan payments are due and the location where they must be sent, a copy of the mortgage or deed of trust, which is the document which secures the note and gives the lender the legal right to make a claim against the property in case you were to default on the terms of the note.

I still do not understand why I have to sign a mortgage or deed of trust on the property if I have already signed a promissory note?

The promissory note is your promise to pay the lender a certain amount of money over a specific period of time, but the mortgage or deed of trust gives the lender an actual “ownership interest” in the property. Until the loan has been paid in full, the lender will retain this ownership interest in the property for his protection. The mortgage document restates the basic information found in the note and spells out your responsibilities to pay principal and interest, taxes, insurance on time, and to maintain insurance on the property and to properly maintain the property and not allow it to fall in disrepair. Please refer to your copy of The Complete Guide to Your Real Estate Closing for further explanation.

Are there any tax tips and after closing advice that you can give me.

Remember that several of your closing costs may be taken as deductions on your tax return. These include any prepaid mortgage interest, property taxes, points, and other fees. Remember that under the new federal tax rule, a single taxpayer is allowed up to $250,000 ($500,000 for married couples) of gain if the property has been owned for at least two of the last five years and had been the owner’s primary residence. Please refer to page 191 of All About Escrow and Real Estate Closings for additional questions which might be of concern to the buyer and seller after the close of escrow.

Related Information

- Final Walk Thru

- How do I prepare for closing?

- When can we move in?

- Closing escrow when you are out of town

- Why the right closing date can make a difference

9. When do I receive a copy of the deed to the property?

The deed will be mailed to the buyer from the recorder’s office after it has been documented (recorded) in the county official records.

Related Information

10. I have a complaint against my escrow company. Who regulates escrow companies in California?

An escrow company in California is subject to the provisions of the Financial Code and the California Code of Regulations under the Business, Transportation and Housing Agency in the Department of Corporations. Address your complaint to the Department of Corporations at 3700 Wilshire Blvd. #600, Los Angeles, CA 90010 or telephone them at (213) 736-2751.

How do I start an escrow company in California?

Any person who desires to engage in business as an escrow agent in California must be a corporation organized for that purpose. In addition, there are several criteria which must be met:

- you must have a $50,000 tangible net worth and $25,000 in liquid assets,

- you must obtain a surety bond of at least $25,000

- the manager of the company must have at least 5 years experience of responsible escrow experience,

- you must be a member of Escrow Agents Fidelity corporation and pay them an initial member ship fee of $3,000,

- all officers, directors, stockholders, managers, and employees will be required to file fingerprints with the initial application, and

- you must pay a filing fee of $625 and an investigation fee of $100.

Real estate brokers, banks, savings and loan institutions, attorneys and title insurance companies are exempt from licensure.

Persons licensed by the Department of Corporations as an escrow agent are subject to the provisions of the Escrow Law (Division 6 of the California Financial Code (FC) and the Escrow Regulations (Title 10, Chapter 3, Subchapter 9 of the California Code of Regulations (CCR). Copies of the California Financial Code may be purchased from Barclays Law Publishers, 400 Oyster Point Blvd., South San Francisco, CA 94080.

How can I find out who regulates escrow in my state?

The Complete Guide to Your Real Estate Closing includes a state-by-state guide to escrow procedures. Order a copy online.

Related Article: How Closings are Handled since COVID-19