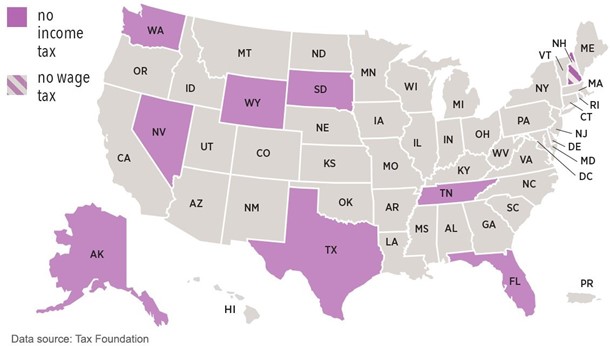

What States Have No State Income Tax?

There are currently nine states which do not require you to file a state income tax return. States…

There are currently nine states which do not require you to file a state income tax return. States…

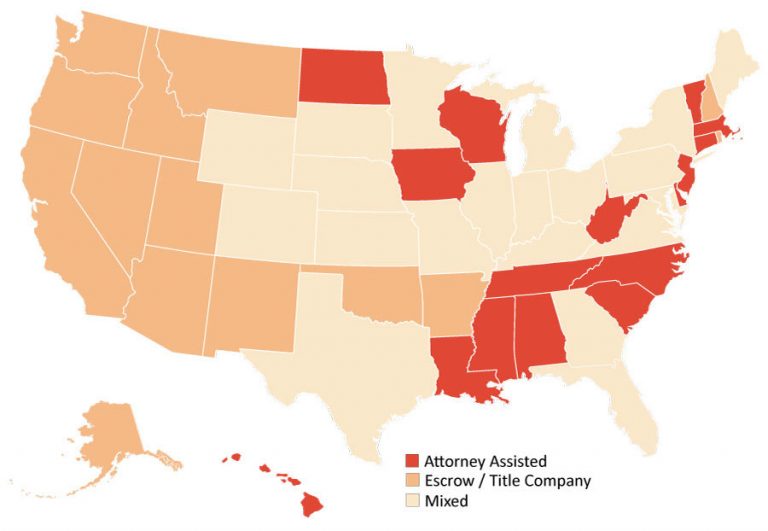

Here is a summary of closing practices for each of the United States. This is a general reference guide. Local practices within your city or county may differ.

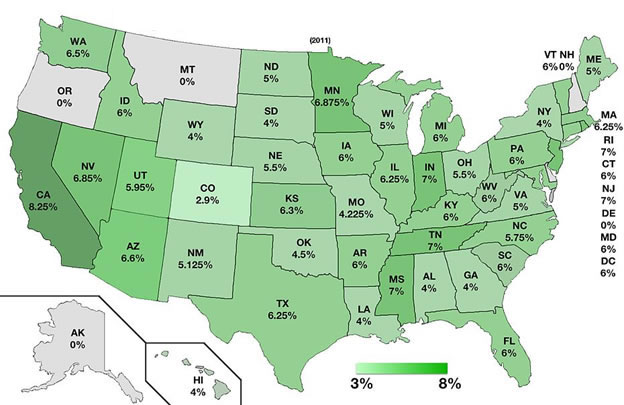

This map indicates individual state sales base-line tax rates. Local sales taxes are collected in 38 states. In…

As of 2021, seven states — Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming — levy no…

Use this handy calculator to figure payments on the loan you are considering.

Buyer Resources Seller Resources Escrow and Closing Resources Real Estate Professionals State and Regional Title Associations Buyer Resources…

“Closing” or settlement or “escrow” is listed as one of the top ten problem areas that occurs in…

Also see the Loan Glossary A Abstract of Title A summary of the public records affecting the title…

Also see the Title Insurance Glossary Adjustable Rate Loan or Adjustable Rate Mortgage (ARM) A loan with an…

The Complete Guide To your Real Estate Closing has helped thousands of home buyers and sellers take control of their closing, saving on closing costs, and remove the mystery and confusion of the settlement process.