How to Choose a Title Insurance Company

Choosing the right escrow officer or title attorney to handle your sale can mean the difference between a smooth and rapid closing or a complicated, delayed closing, fraught with anguish. Most often either the buyer or seller may choose the closing agent, depending on your local custom, but whoever it is, there are several important criteria which should be considered.

Selecting an escrow closing agent, whether it be an escrow officer in an independent escrow office or a real estate attorney in a law firm or title company, is a choice which should be made carefully. This choice will be one of the most important steps in your escrow and closing process as you will be working closely with this person, often daily, throughout the entire 30 or 60 day period of your real estate sale or purchase. Whoever you choose, that person will become your personal secretary, complying with the terms and conditions of your instructions, and they will keep your funds safely deposited in an escrow account. They will strive to be as confidential as possible, answer your questions, and clear up any title problems which may arise.

Let’s look at four important criteria to consider when choosing an escrow officer or title attorney. The first criteria is the reputation of the company in the community. The first place to begin your search is to ask your friends and acquaintances who have had recent experience with real estate transactions to recommend a company or an individual they have been pleased with, one who met all their expectations. Inquire among friends as to the reputation of the individual officer or title company in your local community. Ask your friends if the escrow agent they recommend returns phone calls promptly, explains details in everyday, understandable language, inspires confidence, and is knowledgeable and acts in a professional, courteous manner.

The second criteria to look at is the managerial experience of the escrow agent you are choosing. Look at the professionalism in the escrow agent or title company you are considering. Your escrow agent should be knowledgeable, efficient, friendly, and confidential. Above all else, ask lots of questions when interviewing your potential escrow closing agent. Ask about their previous experience. Have they handled many FSBO transactions? Do they have a good working relationship with lenders and are they experienced in handling loan documents? Do they have experience in handling possible title problems that may be found in the title report?

The next criteria which we will consider is the location of the office of the closing or escrow agent. Since you will have to visit the escrow agent’s office in person at least once and perhaps several times to prove your identity, sign numerous papers, and deliver or pick up a check, try to select an agent with an office conveniently located near your home or work so you can reach it during normal business hours in just a few minutes.

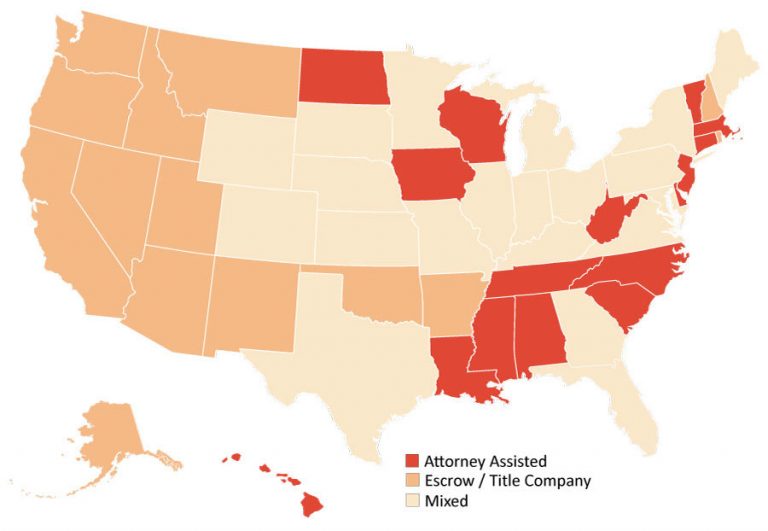

The final criteria to consider is the fees that your escrow or closing agent is going to charge. Fees charged by escrow agents and closing attorneys do vary, and the decision on who pays which fees will also vary from state to state. The seller may be paying for the title insurance, as in Florida, for example, or the buyer may be paying the escrow fees, as in California. Whoever is responsible for paying for each individual fee should be determined well ahead of the closing, and before you choose your escrow or title agent. You will want to try to select the most reputable and professional escrow or closing agent you can find, combined with the one who also charges the most reasonable fees. Several fees, such as recording fees, transfer tax fees, are non-negotiable and will be the same statewide. Title insurance fees and escrow fees can vary from company to company.

You can expect your escrow officer or closing agent to do several specific things for you. Included in the cost of the escrow and title fee will be the following: ordering of the preliminary title report, securing payoff demands/and or beneficiary statements from existing lenders and requesting full reconveyances of any deed of trust or mortgages to be paid off in escrow, obtaining instructions and loan documents from the new lender, obtaining documents to clear any outstanding liens against the property, issuing receipts for deposits of documents and holding funds in a separate account, prorating taxes, interest, rents, etc., preparing buyers and seller’s escrow instructions and seeing that all documents are properly executed, determining when everything is going to be completed so the transaction can close, obtaining title insurance for the buyer and or the lender, arranging timely transfer of the fire insurance policy or seeing that the buyer secures a new policy, recording the necessary documents, such as grant deeds, deeds of trust, powers of attorney, substitutions of liability, and reconveyances, when all the conditions of the transaction have been met, and finally, disbursing all funds to the proper parties, delivering documents and preparing the final closing statements.

After looking at the reputation of the escrow or title company in the community, the managerial experience of the office, the location of the office and the fees charged, choose the closing or escrow agent that you would feel most comfortable working with, asking questions, going over documents and discussing all aspects of your closing process with in detail. Your choice of escrow or closing agent may be one of the most important decisions you make to arrive at your final goal of a timely real estate sale or purchase.

All Rights Reserved. This article may not be resold, reprinted, resyndicated or redistributed without the written permission from Escrow Publishing Company.