Did The Title Company Record a Deed of Reconveyance at The Time of Closing?

A Deed of Reconveyance is used in conjunction with a Deed of Trust and it’s purpose is to clear the title of any liens pertaining to the Note and Deed of Trust which secures that note. The parties involved in the Deed of Trust are the Trustor (the Borrower), the Trustee (title company, bank, or third party), and the Beneficiary (the lender). Once a Deed of Reconveyance is recorded, the title becomes clear of the lien.

In most cases, the title or escrow company will record the Deed of Reconveyance at the time of closing. It is then returned to the trustee, together with the note. The trustee would then forward the note and deed of reconveyance to the borrower. The beneficiary is generally a lending institution and easy to locate, but it in some cases it may be the previous owner or seller.

What happens when the Deed of Reconveyance is not prepared and recorded at the time of closing, and a borrower finds out later, sometimes years later, that an old, paid off loan, still shows up as a lien against his property? This could be a second loan given by the previous owner of the property, or an equity mortgage which was taken out years ago and has since been paid off. What can the borrower do? If the Seller or lender is available, a Deed of Reconveyance can be prepared and sent to the Seller or Beneficiary for signing, recorded, and the lien will be removed.

It is a relatively easy procedure to take care of and an owner may even do it himself. If the Trustee is not available, the borrower can request that the beneficiary sign a Substitution of Trustee form, substitute the previous Trustee for the borrower, and record a Deed of Reconveyance himself.

What happens when the Seller or lender cannot be found or is unwilling to sign the Reconveyance? Is there anything that the borrower can do to clear the title? Although each state may have it’s own procedure which must be followed, the procedure may be similar to the procedure which is followed in the state of California.

In California, for example, when a deed of reconveyance is not executed and recorded within 21 days of the trustee’s receipt of all documents and money necessary to pay off the debt, a title company may prepare and record a release of the obligation within 72 calendar days from payment of the debt. This release is considered equivalent to a deed of reconveyance, releasing the borrower from any further obligation under the deed of trust.

Check with your local title company for the law covering your area. The title company, escrow company, or an attorney should be able to help you prepare the necessary documents to release your obligation under a deed of trust. Once your obligation is released, the lien will be removed from the title.

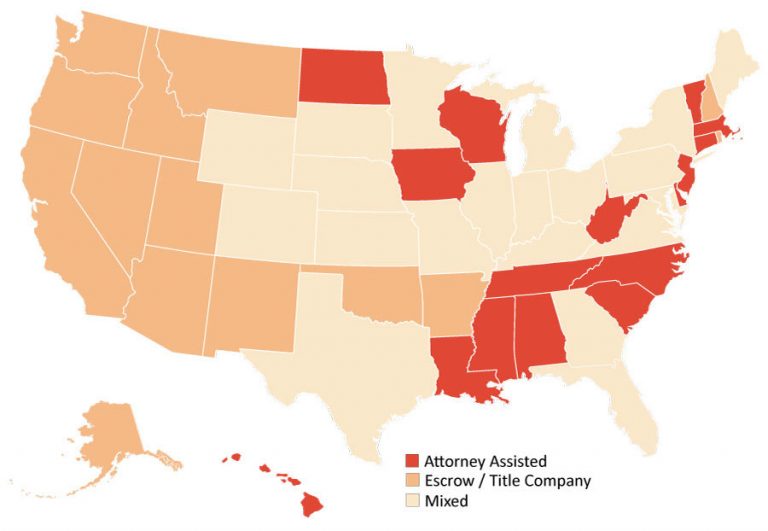

[div class=”tipbox”]The following states may use either our Deed of Reconveyance or Satisfaction of Mortgage depending on whether a mortgage or deed of trust was originally registered to secure the loan: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Washington, Wyoming and West Virginia.

The following states should instead use our Satisfaction of Mortgage contract: Alabama, Arkansas, Connecticut, Delaware, Florida, Hawaii, Indiana, Kansas, Kentucky, Louisiana, Maine, Massachusetts, Michigan, Minnesota, New Hampshire, New Jersey, New Mexico, New York, North Dakota, Ohio, Pennsylvania, Rhode Island, South Carolina, South Dakota, Vermont, and Wisconsin.[/div]

This column may not be resold, reprinted, resyndicated or redistributed without the written permission from Escrow Publishing Company.