Loan Glossary

Also see the Title Insurance Glossary

- Adjustable Rate Loan or Adjustable Rate Mortgage (ARM)

- A loan with an interest rate that changes during the term of the loan. The payments generally increase or decrease with the interest rate. Rate is based on one of several “index” options.

- Amortize

- Payoff off a debt in installments which includes both principal and interest.

- Amount Financed

- A required Truth in Lending Act disclosure for consumer loans. It is calculated by starting with the full amount borrowed (principal) and subtracting out the dollar amount of prepaid finance charges (finance charges the borrower is paying in advance).

- Application Fee

- A fee charged by the lender or broker for the loan application.

- Appraisal

- A report that estimates the value of real estate.

- Appraiser

- A person typically hired by a lender to provide an appraisal.

- Annual percentage rate (APR)

- A required Truth in Lending Act disclosure for consumer loans. It is a calculation of the cost of credit as a yearly rate and shown as a percentage. It is often higher than the interest rate because it incorporates prepaid finance charges that are not interest.

- Arbitration

- A privately conducted trial to resolve a dispute. Arbitration can be binding (in which case there is no appeal), or non-binding, in which an appeal may be possible.

- Aztec Recognition Agreement

- An agreement a bank draws up to give its lien first priority over the co-op’s lien in case the shareholder defaults. Also, the co-op corporation promises to notify the lender if the owner fails to pay maintenance or other fees to the co-op.

- Back End Ratio

- A ratio used in Fannie Mae mortgages which indicates a borrower’s ability to make mortgage payments. Total monthly debt, including expenses such as mortgage payments (made up of PITI), credit-card payments, child support and other loan payments are divided by gross monthly income. Lenders use this ratio in conjunction with the front-end ratio to approve mortgages.

- Balloon payment

- A scheduled payment due at the end of a loan term that is substantially greater than the regular monthly payments. This may be a very large payment. It is designed to occur when the regular payments do not pay off all interest and principal owing (not fully amortizing) on the loan over the term of the loan.

- Borrower

- A person who receives funds in the form of a loan with the obligation to repay the loan in full.

- Broker Agreement (Mortgage Broker Agreement)

- A contract between a borrower and a mortgage broker. It describes what the broker will do for the borrower, and the terms of the agreement, including compensation.

- Broker Compensation or Fee

- The amount of money the broker will receive for finding a loan for a borrower. This may be an amount paid by the borrower, an amount paid by the lender or a combination of the two.

- Cash-out Refinancing Loan

- A loan that refinances a prior mortgage and that provides additional cash to the borrower. funds.

- Closing Costs

- A general term to describe the fees that a borrower will pay at closing. Sometimes called “settlement fees.”

- Conforming Loans

- Loans which conform to Fannie Mae guidelines.

- Co-op

- A unit in a large building operating as a cooperative corporation. Individual units are leased exclusively to purchasers. Buyers are issued shares in the corporation rather than receiving a deed to the property. Special restrictions limit the terms of purchase and use of the unit.

- Courier Fee

- This is a fee that may be charged to send documents or payments by courier, messenger or overnight mail service to various parties involved in the loan transaction.

- Credit Report

- This is a report which is generated by a credit reporting agency (such as Trans Union, Experion or Equifax). It is supposed to show accurately the history of your on-time and late payments on mortgages, credit cards, rent, utilities, and other debts. It may also show how much you owe on your various debts and whether you have taken the maximum amount of credit available to you through credit card borrowing. Your credit reports are used, with other information, to generate a credit score that is supposed to reflect how good a credit risk you are.

- Credit Score

- This is a number that is supposed to show the lender how likely you are to repay a loan–whether you are a good or poor credit risk. This score can be a very big factor in determining whether you will get a loan, from whom, and what interest rate and fees you will be charged for your loan. The score is generated by a mathematical formula that considers your credit reports and other factors. It may also be referred to as FICO score (Fair Isaac Company) or Beacon score or some other name-these are companies that create credit scores. (See Chapter 6 in The Complete Guide to Your Real Estate Closing.)

- Deed of Trust

- In some states loans are secured by means of a document called a deed of trust, instead of a mortgage document.

- Document Preparation Fee

- An amount of money that you may be charged for the preparation of mortgage loan documents. This charge will be shown on the HUD-1 Settlement Statement.

- Equity

- This is the dollar amount of your home that you really own. You can calculate your equity by taking the market value of your home and subtracting out the debt that is secured by your home. For example, if your house is worth $150,000 and you owe $65,000 on a first mortgage and $15,000 on a home equity line of credit. You would take $150,000 – $80,000 (65,000 + 15,000) to arrive at $70,000 in equity.

- Fees

- This is money you pay or is charged to you up front to get a mortgage loan. You may pay fees in cash or finance them (or a portion of them) as part of the loan. If you finance fees, your loan balance will be higher and your equity will be lower. The fees appear on the Good Faith Estimate and HUD-1 Settlement Statement. Many of these fees are negotiable or can be reduced if you shop around.

- FICO

- Credit scores calculated by Fair Isaac Company are often referred to as FICO Normally an average of credit scores taken by 3 national credit bureaus.

- Finance Charge

- The finance charge is a disclosure that appears on the Truth in Lending Act Disclosure Statement. It is intended to show the cost of your loan as a dollar amount. It includes (1) interest that will be charged over the life of the loan and (2) some up front fees (prepaid finance charges). Prepaid finance charges include such items as mortgage broker fees; lender fees; points; and some closing agent fees. Any closing fees that are unreasonably high should also be included. You may also be required to pay other fees that will not be included in the finance charge.

- Finance Companies

- These are companies that make loans which are generally at higher rates than are available from banks or credit unions.

- Fixed Rate Loan

- A loan where the interest rate does not change during the term of the loan.

- Flood Certification Fee

- A fee charged to determine if the property lies in a flood zone and whether flood insurance is required.

- Foreclosure

- The legal procedure by which a lender holding a mortgage on your house forces a sale of your house to obtain repayment of your loan. Foreclosure proceedings are typically started by a lender when you do not pay your loan on time. It might also be started if you fail to pay property taxes or insurance or keep other promises.

- Foreign National

- Term used to describe a person who is not a citizen of the country in which they may be visiting or residing. Used for U.S. taxation purposes to mean someone who is not a U.S. citizen.

- Front End Ratio

- A ratio used in Fannie Mae mortgages which indicates a borrower’s ability to make mortgage payments. It is calculated as an individual’s monthly housing expenses divided by monthly gross income and is expressed as a percentage. Lenders use the front-end ratio in conjunction with the back-end ratio to approve mortgages.

- Fully Amortizing

- This describes a loan where the balance owed at the scheduled end of the loan is zero if all regular monthly payments are made as scheduled.

- Good Faith Estimate

- This document lists the estimated fees you will have to pay to get the loan. It also identifies who is expected to provide services and receive fees in connection with your loan, such as credit bureaus, appraisers, and closing agents.

- Government Recording Fees and Taxes

- Fees and taxes required to be paid to the local government where your mortgage documents are filed.

- Home Equity Loan

- A loan made to a current homeowner that is secured by the equity in the home.

- Homeowner’s/Hazard Insurance

- Homeowner’s or Hazard Insurance is insurance required to protect the mortgage lender against possible damage to your home. It can also protect the borrower. A borrower must obtain this insurance and bring proof of its existence to the loan closing.

- HUD

- The U.S. Department of Housing and Urban Development

- HUD Special Information Booklet

- This is a booklet published by HUD that describes important terms and provides information about the home buying and mortgage loan process.

- HUD-1

- Also called a “Settlement Statement” of all costs and fees in your closing.

- Indorsement

- 1. the act of signing one’s name on the back of a check or a note, with or without further qualification.

2. the signature described above. - Installment note

- a note which provides that payments of a certain sum or amount be paid in more than one payment on the dates specified in the instrument.

- Installment sale

- also known as an agreement of sale or a land contract. This is a method of reporting capital gains by installments for successive tax years to minimize the impact of capital gains tax in the year of the sale.

- Institutional lender

- a lender which makes a substantial number of real estate loans, such as banks, savings and loan associations, and insurance companies.

- Interest Rate:

- Cost of borrowing money expressed as a percentage of the amount borrowed.

- Introductory Rate

- Some loans have a lower introductory interest rate, which is in effect for a limited time. At the end of the introductory period, the interest rate will increase. It is also known as a “teaser rate.”

- Jumbo Loans:

- Loans which exceed the Fannie Mae guidelines for loan size and amount. Jumbo loans may have different guidelines from a “conforming” loan.

- Late Charge

- A penalty you will have to pay if you do not make your loan payment on time. This usually is calculated as a percentage of the payment amount or a minimum dollar amount, such as 5% of the late payment, or $25.

- Lender

- A company or person that makes mortgage loans, such as a mortgage banker, credit union, bank, or savings and loan. Your lender’s name will appear on your promissory note.

- Lender Paid Compensation to Broker

- This is also called the Yield Spread Premium. Fee which the lender pays to the mortgage broker for obtaining the loan for his client.

- Lien

- A claim (legal interest) against a home. Common types of liens include a mortgage, tax lien or judgment lien.

- Line of Credit

- Also called an “open line of credit” secured on your home. Often there are no closing costs involved, or the lender offers to pay all closing costs. Use like a checking account, borrowing credit over time up to your credit limit.

- Loan Approval/Commitment

- A lender’s agreement to make a loan on particular terms, including interest rate, fees and charges.

- Loan Term

- Length of time until your loan is due and payable.

- Mediation

- A process of dispute resolution in which an impartial third party, a mediator, intervenes in a dispute with the consent of the disputing parties and helps them negotiate an agreement. The role of the mediator is to assist the disputants define and clarify issues, help reduce obstacles to communication, explore possible solutions, and reach a mutually satisfactory agreement.

- Mortgage

- A mortgage is a promise in which you agree to put up your home as security for a loan. The mortgage is the instrument which secures the Promissory Note, in which you promise to repay the loan at a certain date. The mortgage document allows the lender to force a sale of your home (foreclosure) if, for example, you fail to make payments, to pay property taxes or insurance, or keep other promises. In some states the mortgage document is called a “deed of trust.” Refer to your copy of The Complete Guide to Your Real Estate Closing for full details of these two documents.

- Mortgage Banker

- A lender, other than a bank, credit union, or savings and loan, that specializes in making residential mortgage loans.

- Mortgage Broker

- A person or company that obtains a mortgage loan for the borrower from another lender. A mortgage broker will not always be representing the borrower and will not necessarily be looking after the borrower’s best interests.

- Mortgage Insurance (PMI or MI)

- Insurance that may be required when a loan is greater than 80% of the value of the home. This insurance protects the lender in the event a borrower fails to make his or her loan payments. The borrower ordinarily pays the cost of MI or PMI, in the form of monthly premiums added to the mortgage payments.

- Notice of Right to Cancel

- Under federal law, you may be permitted to cancel or “rescind” a mortgage loan within a specified time, generally three days, after you have signed loan documents in a refinance, second mortgage or other mortgage loans which do not involve the purchase of a home. . The lender is required to give the borrower notice in writing of this right to cancel or rescind and the deadline to cancel. (read full details in The Complete Guide to Your Real Estate Closing.)

- Open-End Loan

- A loan that permits the borrower to draw money from time to time up to a credit limit. A home equity line of credit (HELOC) is an open-end loan secured by a home.

- Payment Schedule

- This information on the Truth in Lending Disclosure Statement shows the amount of the first loan payment, the amount and number of the regularly scheduled payments (usually monthly), the amount of the final payment, and when all those payments are due. The actual payment due may be greater for a number of reasons, including taxes and insurance. If the loan has an “adjustable rate,” the actual payments will differ from the payment schedule.

- Points

- A fee charged by the lender as additional compensation for making the loan. One “point” is equal to 1% of the principal amount of the loan.

- Prepayment Penalty

- The charge which can be imposed if you pay off your loan before maturity. The Truth in Lending Disclosure Statement will show whether a loan has a prepayment penalty.

- Prime Loan

- A loan offered to borrowers with better credit history (sometimes called “A” loans). Prime loans generally are priced lower and cost the borrower less.

- Private Mortgage Insurance

- Private Mortgage Insurance (PMI or MI)- Insurance required to be paid for by the borrower to protect the lender in the event payments are not made on time; most often required when the loam amount exceeds 80% of the purchase price.

- Processing Fee

- A fee charged by lenders or brokers to prepare a complete loan application file. A processing fee may be charged to the borrower and shown on the Settlement Statement (HUD-1).

- Promissory Note

- A legal contract in which the borrower promises to pay back the loan. The “promissory note” sets forth the terms and conditions that apply to the loan repayment, such as interest rate, when payments are due, where payments are made, what happens if payments are not made, etc.

- Purchase Money Loan/Mortgage

- A loan for the purpose of purchasing a home.

- Rate Lock (Lock in the Rate)

- Refers to the agreement between the borrower and the lender or broker that as long as the loan is closed within a certain period of time (for example, 30 or 60 days), the interest rate on the loan will be set (locked) at an agreed- upon rate. A “rate lock” agreement must be in writing or it will be unenforceable.

- Recording Fees

- Fees charged by the local government to record loan documents (for example, the mortgage). These fees will be charged to the borrower and shown on the Settlement Statement (HUD-1).

- Refinance

- To repay one or more existing mortgage loans by getting a new mortgage loan.

- Rescind (also Right of Rescission)

- Literally means “to take back” or “cancel.” If a borrower rescinds a mortgage loan, it is as if the mortgage loan never existed. Some borrowers have by law a right to “rescind” certain mortgage loans. Note: A Borrower is entitled to a refund all fees paid in connection with the loan if the Borrower exercises his right of rescission.

- Secondary Mortgage Loan

- A mortgage loan that is in addition to a mortgage that already exists on the home.

- Settlement

- The time when loan and mortgage documents are formally signed and the loan transaction is completed. Sometimes called “Closing.”

- Settlement Agent (may also be called closing agent or settlement attorney)

- The person who organizes and is in charge of the loan closing. The settlement agent is the person who can explain any document the borrower must sign.

- Settlement Statement

- A mortgage loan closing form required by HUD that is often called a HUD-1. It provides details of all charges and payments made in connection with your loan, and shows to whom they are distributed.

- Sub prime Loans

- These loans are priced higher than prime loans, often much higher. Loans to borrowers whose credit is less than perfect will almost always be subprime loans. There are also other circumstances that lead to subprime loans, including high outstanding debt, unproven income, etc. Even borrowers with good credit may receive subprime loans for a variety of reason, including fraud, discrimination, failure to shop around, etc.

- Survey

- A drawing or map showing the precise legal boundaries of a property and other physical features, prepared by a registered land surveyor

- Term

- The period of time during which loan payments are made. At the end of the loan term, the loan must be paid in full.

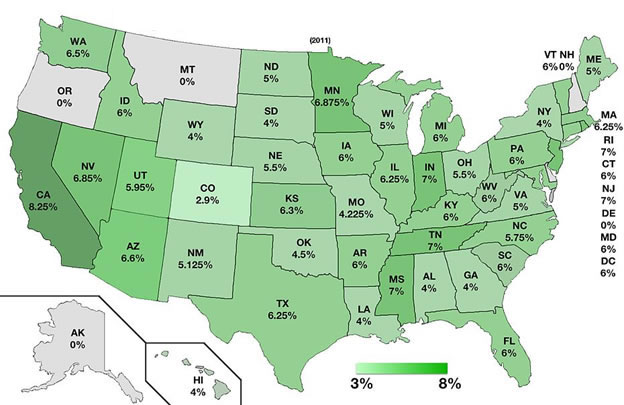

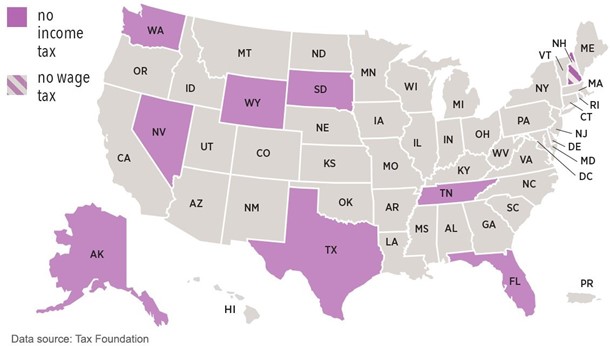

- Transfer Tax or Charge

- This is a government tax or charge that is usually based on a percentage of the property value or loan amount and imposed by state or local law. Many states do not require this charge for a refinance loan, but almost all require it for a home purchase. A transfer tax will be shown on the Settlement Statement (HUD-1).

- Truth in Lending Act (TILA)

- This is a federal law designed to protect borrowers and to give them enough information to comparison shop for loans. TILA requires certain disclosures about the loan and when they must be given to the borrower. TILA also provides additional protections and prohibitions.

- Truth in Lending Disclosure Statement

- This is a very important document that federal law requires for all consumer loans.] It provides key information to enable borrowers to shop around and compare loan terms from various lenders.

- Underwriting Fee

- This is a fee charged by the lender to evaluate whether the borrower qualifies for a mortgage loan. An underwriting fee may be charged to the borrower and shown on the Settlement Statement (HUD-1).

- Up Front Costs

- These are costs or fees which are charged to the borrower at or before closing of the mortgage loan, such as loan application fees, appraisal fees, points, broker fees, credit report fees, real estate taxes, etc. Up front costs can be paid in several ways: (1) they can be paid by the borrower in cash; or (2) they can be added to the loan amount and financed over the life of the mortgage.

- Yield Spread Premium (YSP)

- This is a payment made by a lender to a mortgage broker in connection with a borrower’s mortgage transaction. It is shown on the Settlement Statement (HUD-1), but often in a way that is difficult to understand. For example, a $1,000 yield spread premium may be shown as “YSP POC 1000.” Borrowers are often unaware that the YSP payment is being made. The payment of a YSP by a lender affects the interest rate charged to the borrower.

This article may not be resold, reprinted, resyndicated or redistributed without the written permission from Escrow Publishing Company.