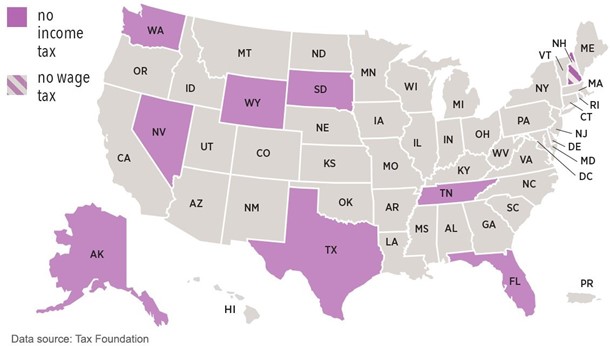

What States Have No State Income Tax?

There are currently nine states which do not require you to file a state income tax return. States…

There are currently nine states which do not require you to file a state income tax return. States…

One of the most important decisions that needs to be made at closing is how you choose to…

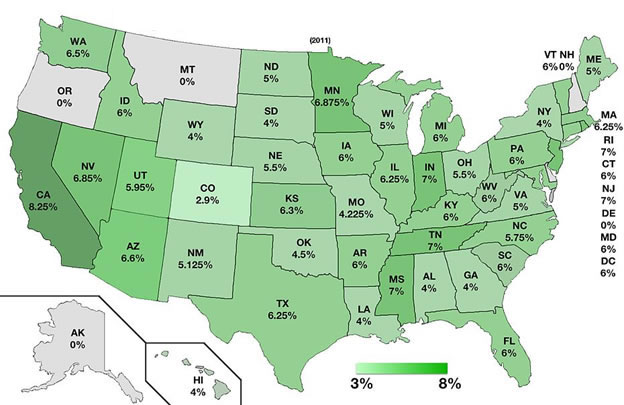

This map indicates individual state sales base-line tax rates. Local sales taxes are collected in 38 states. In…

If you are a Beneficiary of a Trust and the Trustee will be distributing the assets towards the…

Seller financing can be a useful tool to not only the Buyer but also to the seller. With…

As of 2021, seven states — Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming — levy no…

The 2016 tax year officially opened Jan. 19 when the Internal Revenue Service started accepting 2015 tax returns….

What is the IRS Form 4506 which I might be asked to sign at closing? Form 4506 is…

There are currently seven states which do not require you to file a state income tax return. States…

The Tax Reform Act of 1986 required anyone responsible for closing a real estate transaction, which may include…

The First Time Homebuyer Credit is a credit available to taxpayers who purchase a primary residence during the…

Installment sales are used to help spread out capital gains on a property for a period of more…

A trust is an arrangement which dictates how your assets are to be managed and distributed. Trusts are…

The Taxpayer Relief Act of 1997 has replaced the old Rollover Residence Replacement Rule, IRS Code Section 1034,…

Knowing when to close your real estate purchase can work to your advantage at tax time. You may…

Among the various items which will be prorated, or shared between the buyer and seller at the closing…