How to Protect Your Home from Title Fraud (Often For Free)

Title theft is a type of crime where scammers replicate your signature to create a fake deed, loan document, or place a lien on your property. This allows fraudsters to potentially sell your property without your knowledge. Sophisticated criminals have learned how to impersonate home owners by creating fake IDs online, as well as fraudulent notary stamps, giving nearly every computer the technology to create believable forged documents. Unless you regularly check the county tax records, there is no agency that lets you know the fraud has taken place.

Title insurance protects homeowners from any “defects” in the title – such as deeds, mortgages, liens, foreclosures, and tax assessments prior to the date of transfer from the seller to the buyer. A title search examines all the documents that exist in the public records but will not include documents that have not been recorded.

For that reason, title insurance may not cover fraudulent activity such as fake deeds, forged signatures, loan documents or other criminal activity that happens after the transfer of title. Your policy of title insurance may offer help to close accounts and secure ways to protect your interests, but collecting money that is already in the hands of devious criminals is often very difficult and often impossible to recover.

Not long ago, one of the most iconic and famous homes in the U.S., Graceland, the former home of Elvis Presley, became the target of scammers who came alarmingly close to taking over ownership of the property. You might wonder how was it possible that someone (other than the owner) could transfer ownership of the property without the owner’s knowledge or consent?

In the case of Graceland, a company called Naussay Investments and Lending presented documents claiming to show that Lisa Marie Presley, Elvis Presley’s granddaughter and the then rightful owner of Graceland, had borrowed $3.8 million from Naussay Investments and that Presley used Graceland as collateral for the loan. This was one-hundred percent a fabrication. Naussay Investments were able to record these and other forged documents with the County Clerk’s office without Presley’s knowledge or consent.

Fortunately for Elvis Presley’s granddaughter she became aware of the fraudulent transfer in time and was able to bring a lawsuit in time to protect the estate from going to auction. A Tennessee judge ultimately stopped the sale.

According to the Federal Bureau of Investigation, property and mortgage fraud is one of the fastest-growing crimes in the U.S. It was reported recently that 1 in 20 Americans who bought or sold a home within the last three years have been victims of some type of real estate fraud with the average loss of $70,000.00.

How Scammers Get Your Information

Scammers use public records to gather information and pose as someone else—you the property owner. They can impersonate someone in a legitimate real estate transaction and redirect and steal money, or they could pose as the owner of a property and negotiate the sale of a property. A title thief can make themselves look (on paper) like the legal owner and if all the forms are filed out correctly, the county officials are obligated to record and file the document.

County Clerks and Recording offices do not check the validity of documents presented to them for recording, including notary signatures or forged Deeds, as they have no obligation to notify the existing owner of an (unknown) fraudulent act.

How to Protect Your Property For Free

Similar to how a credit card company or your bank will notify you if they suspect “fraud” or unauthorized charges on your accounts, there is a way to register your property with your county assessor’s or tax collector’s office for a similar notification service.

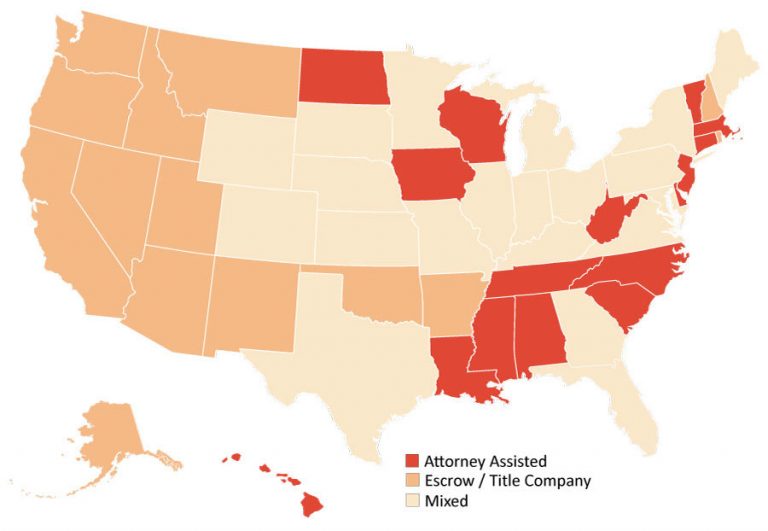

Many states offer a free title property fraud alert system through their County’s Register of Deeds or Comptroller’s office. This servicewill notify you when a document is recorded against your property – such as any type of deed, deed of trust, mortgage or lien document. The state agency does not prosecute or report criminal activity to the authorities, but by giving you the information of “suspicious” activity as soon as it happens, you can then take swift action to remove and reverse the fraudulent acts.

How to Sign Up for Free

1. Go to your County Clerk’s Comptrollers or County Assessor/Recorder/County Clerk’s office

2. Type in Free Real Estate Fraud Notice Service

3. Go to your property’s Assessor’s Parcel Number or (APN) from on the Assessor’s website or located on a copy of your property tax bill

4. Sign up for the free Real Estate Fraud Notice service.

Registering for this service doesn’t prevent fraud – but it gives you an alert so you can contact the police or other authorities to take action to stop the crime before anything disastrous occurs.

Online Title Fraud Insurance Companies

In states which do not offer a free title fraud alert program, there are online companies that sell a type of title insurance coverage that will inform you when fraudulent documents are recorded against your property. These companies usually offer 24/7 monitoring to detect any tampering to your title or mortgage. They may offer a “restoration service” to work with lawyers and experts to help restore your clear title.

The fee is generally reasonable – in the range of $20 a month or discounted rates for an annual membership.

A word of caution when looking for any online service. Be certain that you are dealing with a valid, reliable company with a legitimate website.

If your state does not offer a fraud alert service, you could notify your Assessor or Property Tax Collector and recommend that they add this valuable service for their residents.