State by State Closing Guide

Here is a summary of closing practices for each of the United States. This is a general reference guide. Local practices within your city or county may differ.

Here is a summary of closing practices for each of the United States. This is a general reference guide. Local practices within your city or county may differ.

(Most states require sellers to fill out a disclosure form or disclose material facts about the property. To…

One of the most effective ways of avoiding one or more of your closing costs is to ask…

Buyer’s Home Closing Checklist Have you made a final walk-thru inspection of the property? Is the condition of…

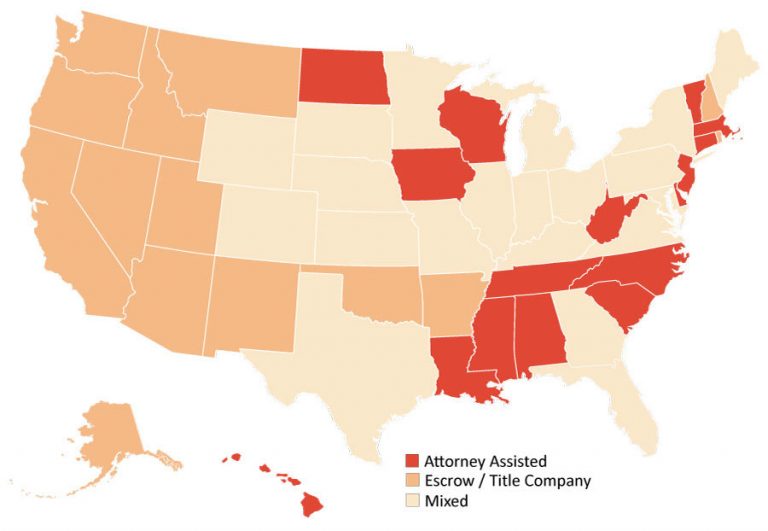

Real estate closings may be handled by escrow companies, title companies, lawyers, or a combination of one or…

When you begin shopping for the best home price, mortgage rate, insurance premium, and lender closing costs, so…

Escrow impound accounts are those accounts which lenders set up to collect “up-front” money from you when you…